Lang, long it was announced, now she is at the door and the excitement is great– the amendment of the tax calculation for online mail order business within the EU.

From the 01.07.2021 There are no country-specific export / import limits for cross-border trade and a uniform limit of € is drawn 10.000 (net) a.

I don't want to go into too much detail, as many others have already done so. Much more, I want to give you an overview and an update very briefly. At the end I will continue to provide an outlook on a suitable and highly convenient Magento (2) – Give extension, we are currently creating.

1. What is it basically about?

The innovation is all about B2C online retail (Trade with consumers) in the EU.

Is not affected by the change

- trade with third countries outside the EU

- and of course within your own country.

- B2B online trading is also not affected (Trade in commercial (Between-) Customers. For easier differentiation and greatly simplified– as soon as an EU customer provides a valid VAT ID, he can place the order tax-free. However, if an entrepreneur buys without this tax ID, he becomes a normal consumer on the tax side and pays VAT.)

So sell goods to consumers outside your tax country in an EU country via your online shop, you are basically already affected by the change.

The decisive point is now the sum of sales, that you have made and are doing with EU B2C orders within a calendar year. We come to that in the next point.

2. What limits(“Delivery thresholds”) apply to / will apply?

So far there is still a country-specific limit. Any EU country can do this (more or less) determine yourself. They are currently between € 35.000 and € 100.000. Germany, Luxembourg and the Netherlands, for example, have. a delivery threshold of € 100.000. Again: This delivery threshold relates to the total of sales (net) to the country concerned within one calendar year.

Will be new now, that from the individual delivery thresholds per EU country one “EU foreign delivery threshold” is. So all sales from B2C business with EU countries are totaled in the calendar year. Come to an amount of > € 10.000 (net), are you concerned.

Was the subject “Delivery threshold” so so far not relevant for smaller shops, is that from 01.07.2021 quite fast.

So when you're at point 1 have established, that you are concerned and now also at point 2 after a short rough calculation “In, Congratulations” to think, then, firstly, you are not alone and, secondly, you are right here, since it is now relevant.

BY THE WAY: The sum of the sales refers to the Dealer and not on the project! I am writing this consciously, because there was one and the other, who runs and determined several shop projects in parallel, that none of the shops can exceed the € 10k threshold. The joy quickly evaporated after the clarification.

And one more thing: Affected by the delivery threshold are so-called. “Intra-community distance sales” So e.g.. normal trade in goods according to §3c UStG as well as “Digital services” such as streaming applications etc. according to §3a V UStG.

3. What does this mean in concrete terms??

Basically there is no change here. In a nutshell, you are when the delivery threshold is exceeded

- taxable in the country of the ordering party = the EU country to which the order is being delivered

- subject to tax at the tax rate applicable in the specific EU receiving country = between 0 and 27%

That was so, is and stays that way. The difference is now this:

Until now, you had to file a corresponding tax return in the respective country. Example: Merchant A from Hamburg sells goods totaling an order value of in the calendar year > € 35.000 (net) according to Austria, so he is fundamentally obliged to pay the taxes for these orders not in Germany but in Austria. The general tax rate in Austria (there are three in total) lies by 20% and thus 1% higher than in Germany. To do this, trader A must register for sales tax in Austria and submit a tax return there for all AT sales and pay the tax due there. In addition, the involvement of a local tax consultancy was usually necessary.

Every dealer can continue to do this if they wish, if he so wishes. German traders, the e.g.. For years we have made a large turnover with orders from Austria but do NOT ship any goods to other countries, could continue to do so without any problems. But as soon as you send just one order to any other EU country, are they also taxable in this country – from the first euro (since they are the 10k EU-saleshave already exceeded the threshold simply by doing business with Austria).

Für alle (and most will be, offer across the EU), there will be a relief in the aggravation here in the future. It then no longer has to be reported and paid for in each country individually, but via a central point of contact – the One-Stop-Shop or “US“. In Germany, this central point of contact is the Federal Central Tax Office = BZSt.

You report to this on a quarterly basis (31.01. / 30.04. / 31.07. / 31.10.) the collected sales of the respective EU countries and also pays the due tax to the federal treasury. From there everything is forwarded to the EU countries.

So you save yourself

- the tax registration in every EU country in which one is / becomes taxable.

- the Tax return per country in the respective country (and possibly. the necessary tax consultancy costs)

- the Single transfers of the tax amounts due in the respective EU country

After the first horror and aggravation of further bureaucracy, this at least reconciles one a little.

What annoys again, however, is the lack of plan with which this is being pushed, because on the one hand there are still many question marks in the room and on the other hand many providers of control software do not yet provide any solutions, to meet the requirements. Ja – the first message has to be sent to 31.10.2021 take place but there are certainly one and the other, who wants to and has to start posting as early as July. It would be nice there, if more specific things were known, so that one can deal with it.

Since it is unfortunately still very difficult at the moment, to find concrete statements, I have compiled the following information and examples in the last few days and would like to give a few clear examples:

Question: I had in 2020 about 10k EU sales, in 2021 but so far none 10k - What do I have to do? Answer: I have to 01.07.21 calculate the country of destination taxes & identify and report via the OSS. Background: I had over € 10.000 EU net sales in the previous year - that means sales tax liability in the EU target country for the current and the coming year.

Question: I had in 2020 under 10k EU sales, in 2021 until 30.06. about 10k - What do I have to do? Answer: I have to 01.07.21 calculate the country of destination taxes & identify and report via the OSS. Background: I have over € 10.000 EU net sales in the current year - that means sales tax liability in the EU target country for the current and the coming year.

Question: I had in 2020 under 10k EU sales, in 2021 (up to and including. 31.12.) under 10k - What do I have to do? Answer: It stays the same. It is still taxed at the country of departure tax rate.

Question: I had in 2020 under 10k EU sales, in 2021 until 30.06. under 10k but i reach on 16. October the 10k - what do I have to do? Answer: The order, which leads to exceeding 10k EU sales, is the first, which already has to be taxed at the tax rate of the destination country. All of the following too, of course. So I have on 16. October an EU foreign turnover in the amount of. € 9998,- (net) and sell a product for € 5,- (net) to an EU country, this must already be taxed in the destination country and at its tax rate. By the way: All previous sales remain unaffected! There is no retroactive effect on previous tax processes due to the change to the target country taxation. It is only from this point in time that you become taxable in the destination country.

4. What should I do?

I think, that it makes sense to divide into two areas:

- administrative / accounting:

After the discussion, whether you are affected by the changes (ours also helps here neue Extension – Info in the penultimate paragraph), you have to contact the tax advisor, to on the one hand the topic “OSS procedure” to discuss and to clarify whether a registration and participation in this procedure makes sense or. necessary is. Then the registration has to be done via a new portal of the BZSt. with the resounding name “Mein BOP” (LINK) occur. Für alle, who are wondering, was “BlowTheout Presell” has to do with our tax return – that stands for “Band Central Tax Office Thenline-Portal”.

Next must be ensured, that the accounting program used / the tax advisor is able to address this BOP correctly.

IMPORTANT: The registration MUST be officially registered / Registration BEFORE the quarter in which you want to participate in the OSS. That means specifically, if you start from the third quarter (01.07.2021) wants to participate, You have to be up to 30.06.2021 have registered. Shouldn't you have done this, but be or will be subject to destination country tax this quarter, In the worst case, you have to go the old way and in every country (in which one delivers) separate registrations, Messages & Make payments.

2. Shopseitig:

- Here you should basically think about reporting, which provides you with the specific EU sales differentiated according to the desired period. One function, which has not yet been planned in Magento and in this new case leads to an insufficient supply of information. Here we come to our new extension in the penultimate paragraph of this article.

- Furthermore, the tax rules must be significantly expanded, to meet all requirements. Static statements like “including. 19% VAT” will then no longer be possible. To this should be mentioned, that when quoting prices in the online shop, the customer is generally only required to state the gross price (§ 1 PAngV). On the other hand, it is not required to state the VAT rate specifically included in the gross price. So it is enough “including. Tax” (and possibly. “plus. Shipping”) to write. We have a simple standard import file for Magento 2 created, the respective standard VAT rate of 27 Includes EU countries.

For Magento 2

For Magento 1 (Versions from 06.07.2021 with updated rates for Latvia, Romania as well as set for Monaco and “Northern Ireland” (GB BT *) – Thanks to Matthias for the support)

I have now made the effort again “discounted” EU tax rates for an occasional magazine (Customs tariff number 49029000) to pick out. I still do not take over any guarantee for the correctness. It is striking, that no reduced tax rate will be used for the following countries and therefore the normal tax rate will be applied. I still have the tax rates in the list and also with one “erm.” Mistake: Denmark (25%), Italy (22%), Cyprus (19%). UK bzw. in our case Northern Ireland has as far as I could see 0% VAT. on magazines, therefore this is also with 0 given.

For Magento 2 (reduced)

For Magento 1 (reduced) - Lastly, you have to ask yourself the question, how to calculate sales prices. One calculates – as in the standard – the VAT included in the total price, one also generates deficits in trade with countries >19% Tax.

In addition a small calculation example:

An article, the gross € 99,95 costs, contains € in Germany 15,95 VAT, which is to be paid to the state. So there remain € 83,99 in your own cash register.

If you sell the same item to Hungary (27% Tax), fall whole € 21,25 VAT. on and only € remain 78,70 in your own company = € 5,29 Less!

So one more point, that one should take into account, when selling across the EU.

I would like to expand the second point a little, as it is very relevant to Dealer with a lot of EU foreign sales. For this it is worthwhile to look more closely at the past sales and to look, how this would have changed, it would have been generated under the new VAT rule. This is for the following reason: for most shops the “Eyes shut and go for it-“Solution offer where the gross price remains unchanged and only the net price varies based on the shipping country selected in the checkout. Basically, you will rarely make a profit with this solution, of (current) only two EU countries less VAT. (Standard rate) call as Germany – namely Luxembourg (17%) and Malta (18%). Romania and Cyprus also have 19% VAT. but all other EU countries have more VAT. as we. Incidentally, the average EU VAT rate is included 21,5% – Standard rate.

VERY IMPORTANT if the gross price is to remain the same!

Both with Magento 1 as well as Magento 2 has yet to be communicated to the system, that the gross price should always remain the same – even if a customer from e.g.. Hungary ordered. Despite the attitude, that the gross prices are stored in the catalog, Magento will recalculate the gross price after entering the shipping country at the latest. To prevent this and really always have the same gross price, you have to proceed as follows:

Magento 1: System> Configuration> Sales> Tax> Calculation. Here must be “Enable Cross Border Trade” a “Ja” be set.

Magento 2: Shops> Configuration> Sales> Tax> Settings for the calculation. Here must be “Enable cross-border trading” a “Ja” be set.

The problem then is though, that the gross price even with 0% orders in Third countries bestehen bleibt. So if you also send to third countries, unfortunately has a problem here. We have already created a solution internally for a number of projects, which intervenes here. We'll post it here when there's news.

What are the other options?

The “Unrivaled happiness”-Solution: This will probably only be relevant for companies, the none / have little competition. The idea here would be to simply increase the gross price by x%, around at (for the company) relevant net price buffer to have. So a mixed calculation.

The “IT-effort-I-don't-care-“Solution: The establishment of shop instances per country or per VAT rate. It is important against the background of the geoblocking ban of 2018 not simply redirecting the user to a page without their explicit consent. But you could inform the visitor about this when entering (juhu – again a popup!), that a delivery in this shop area is only possible to X.. For deliveries to Y, he would be redirected to the other shop area. You can then ensure via the delivery country settings, that it really works.

“Geoblocking? Wasn't there something with the price and the disadvantage of other EU countries?” – right! But the price, which is decisive for compliance with the geoblocking regulation, is according to. of the REGULATION (I) 2018/302 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 28. February 2018 article 2 Nummer 14 – the net selling price. This must therefore remain the same and cannot be passed on to anyone because of their EU residence “discriminate” (what this word must be used for).

So there are two things to keep in mind, if you want to go this solution:

1. The visitor must explicitly agree and must not be redirected automatically.

2. The net prices must remain the same, the gross prices may vary.

You can now argue, whether this change makes sense or is again a brief and unrealistic ABM from Brussels, but you have to pay attention, that since the enactment of the VAT regulations of individual countries regarding. of cross-border trade has done a lot in recent years and meanwhile it hardly makes any difference to the consumer, whether you order in your own country or in another country. Sometimes you don't even get to know where the product was actually sent. So it is obvious to deal with the tax. The idea of the OSS is also fundamentally good, because they - let's be honest- makes trading across the border even feasible for most traders. Personally, I think the threshold of 10k is too low. At average 21,5% VAT. would that be € 2150,- Tax, to be distributed. Whether this is proportionate to the bureaucratic effort of everyone involved, I would like to doubt.

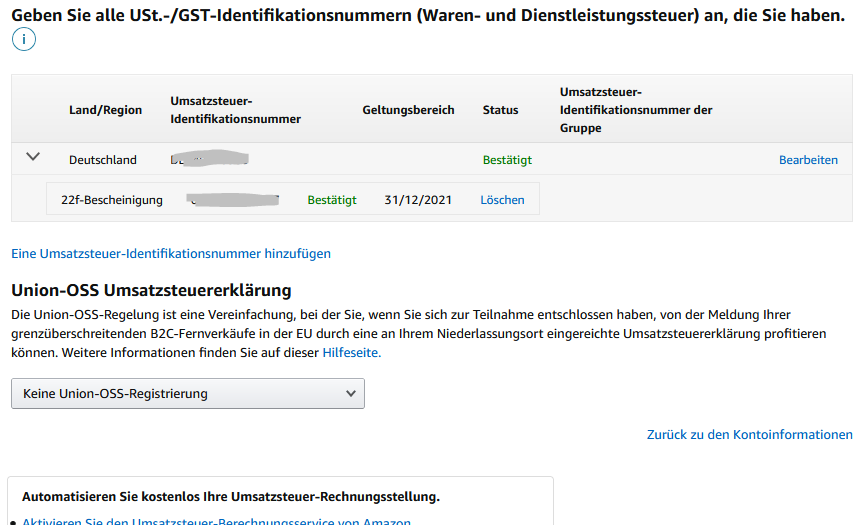

Are you a seller / Dealer on Amazon, there is already some information. At Amazon you can go to your seller account under “Settings > Tax settings > Add sales tax numbers” his valid VAT ID (in D this begins with DE) deposit. This is from 01.07.2021 mandatory for trading on Amazon. Without this it will turn off 01.07.2021 EU trade is automatically prevented. The previously sufficient 22f certificate is no longer sufficient!

The OSS process can also be activated in this menu. To do this, you select your own country of departure.

Amazon will then automatically (probably only from 01.07.) activate the target country tax rates. Here, of course, the pricing is a little more cumbersome as shown above.

EBay is off 01.07. also the filing of the VAT ID. mandatory (LINK) – Here, too, the certificate according to 22f is no longer sufficient and trade in other EU countries would automatically be prevented. More information regarding. Activation of OSS or. So far, I have not been able to find destination taxation.

The Amazon theme “PAN” – So when it comes to fulfillment via Amazon and their EU warehouses, this is discussed in detail elsewhere. The topic is also tricky “I have warehouses in other EU countries from which I send goods”. This topic is also discussed in many places, which is why I do not want to go into this.

Finally, a few links to pages, which can be helpful for the topic:

- VAT calculator

- Current VAT rates and thresholds at Haufe

- Elster – BOP

- Taxes in the EU

- IT law firm

- Taxdoo – US

- Very extensive YouTube webinar by Amainvoice

And finally, an announcement of the extension: Because we got to know the effort for a detailed overview of all EU foreign orders in various projects, we were looking for a simplification, in order to be able to deliver numbers always and in real time. Despite various reporting functions from Magento, such a function is so far unknown. Therefore we are currently creating one for Magento 2 (If there is sufficient demand and a binding order, also for Magento 1). This is as an extension “EU sales report for tax calculation 01.07.2021” from now on with us at Commercers-Shop to find.

P.S. Find support with your Magento online shop project? Please contact us at!

P.P.S. All information has been compiled to the best of our knowledge, but are not tax or legal advice and without guarantee.

A tax rate for Northern Ireland is missing from the tax rates download?

Hi Matthias!

I currently don't see any possibility of distinguishing between Ireland and Northern Ireland in the rules. There should be a country code, but so far there is only Ireland. “Ireland” it's me. Südirland (actually “Republic of Ireland”) and Northern Ireland would have to be GB? The standard tax rate of Northern Ireland is in my opinion. at 20%

Well, the question is, whether a tax zone for United Kingdom, limited to the postcode area “BT*” with 20% missing.

Good point. But I haven't given any further thought to this yet.

I had also just seen an error in the CSV file and fixed it (new version). Erroneously at the entry “Germany 19%” the country code for Denmark (DK) stored instead of DE. Please note!

For deliveries to the Principality of Monaco, sales tax is probably also due and should therefore also be listed in the table.

The values for Latvia and Romania also seem out of date.

Hi Matthias, thank you for your comments – but it would be nice, if you would write in right away “was” and not only “that something” missing or out of date.

I was hoping for an external exam.

LV: 21%

RO: 19%

MC: 20%

GB BT *: 20%

I'm not a tax advisor, therefore I only collect the data from external sources. Thanks for the input. I updated and re-uploaded the two files.

I now have the reduced EU tax rates for one now and then again (so not daily or weekly) published magazine as download for Magento 1 und Magento 2 set. Comments are welcome.

Ireland is absent (Magento: “IE”)